how much taxes will i owe for doordash

As such it looks a little different. That money you earned will be taxed.

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Between my mileage deduction and other deductions for hot bags cell phone bill new work phone title and registration fees Etc my deductions are 187610.

. 90 of current year taxes. Taxes apply to orders based on local regulations. Any income that you earn including self-employment income from a gig marketplace like DoorDa.

Each year tax season kicks off with tax forms that show all the important information from the previous year. Well go over tax forms when to file and how to get your lowest possible tax bill. Mileage or car expenses.

The type of item purchased. The date and method of fulfillment. Instead you need to keep track of how much you owe based on what youve earned working with Doordash.

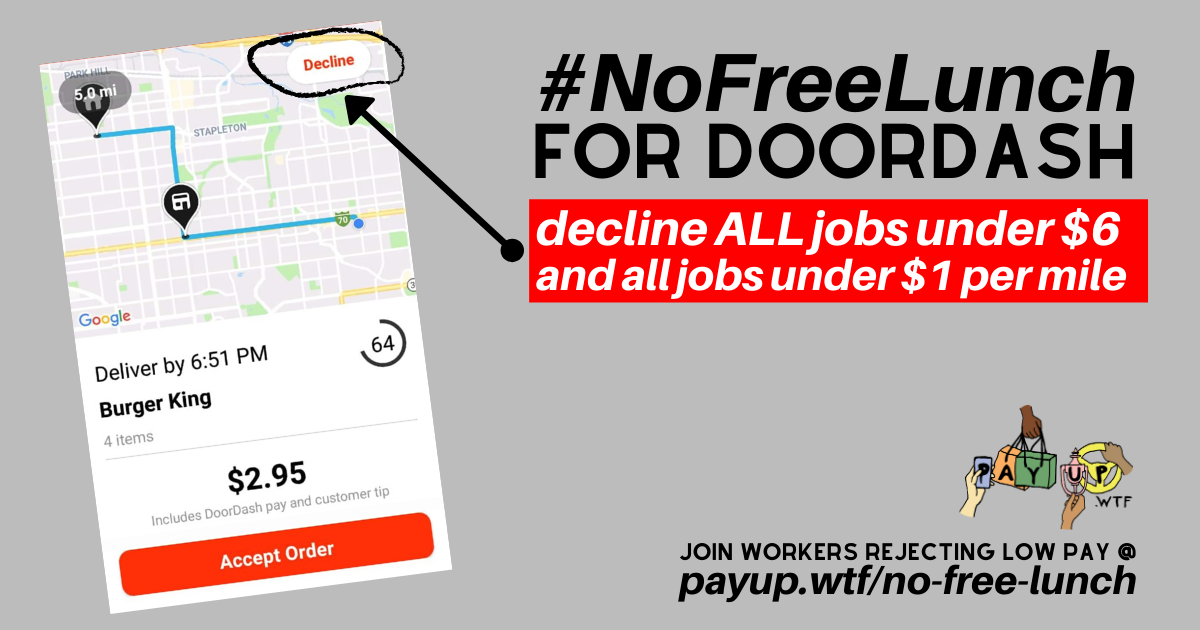

Yes - Just like everyone else youll need to pay taxes. The time and date of the purchase. One of the best tax deductions for Doordash driversor any self-employed individualsis deducting your non-commuting business mileage.

All income you earn from any source must be reported to the IRS and your states Department of Revenue. For 2020 if you make more than 600 in self-employment income you have to file a tax return. Alternatively you can keep track of your vehicle.

Answer 1 of 2. To compensate for lost income you may have taken on some side jobs. How are Taxes Calculated.

If you know what your doing then this job is almost tax free. Doordash taxes Taxes Tade Anzalone January 18 2022. That way youll know how much to.

Not very much after deductions. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. How much can you make on DoorDash without paying taxes.

If youre a Dasher youll be getting this 1099 form from DoorDash every year just in time to do your taxes. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. Facebook 0 Twitter LinkedIn 0 Reddit Pinterest 0 0 Likes.

If you earned more than 600 while working for DoorDash you are required to pay taxes. There are various forms youll need to file your taxes. This includes miles that you drive to your first delivery pickup between deliveries and back home at the end of the day.

Answer 1 of 5. Internal Revenue Service IRS and if required state tax departments. Incentive payments and driver referral payments.

The amount of tax charged depends on many factors including the following. Learn how much should you set asi. Take a look at this complete review to Doordash taxes.

Instead you must pay them yourself at tax time or if you make enough by making estimated tax payments throughout the year. An independent contractor youll need to fill out the following forms. If youre a Dasher youll need this form to file your taxes.

I made about 7000 and paid maybe 200 in taxes after all the deductions. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

To avoid the estimated tax penalty you must pay one of the above percentages through a combination of estimated tax payments and withholding. The answer is NO. Im only paying 900 in taxes on my DoorDash earnings after making 26k last year.

As such DoorDash doesnt withhold the taxes for you. Form 1099-NEC reports income you received directly from DoorDash ex. AGI over 150000 75000 if married filing separate 100 of current year taxes.

How Do Taxes Work with DoorDash. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. The location of the store and your delivery address.

Dashers will not have their income withheld by the company to pay for these taxes so youll need to pay them on your own. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. It doesnt apply only to DoorDash employees.

Independent contractors still owe these taxes but are considered self-employed. A 1099 form differs from a W-2 which is the standard form issued to employees. 1099 Tax Rate for 2022 and 5 More 1099 Worker Tax Tips.

Heres your complete guide to filing DoorDash 1099 taxes. A common question is does Doordash take out taxes. To avoid being taken by surprise check how much youll owe using our 1099 tax calculator.

The self-employment tax is your Medicare and Social Security tax which totals 1530. You can deduct expenses from that income such as mileage uniforms supplies part of your cell phone service and other overhead expenses you might incur. If you earn more than 400 as a freelancer you must pay self-employed taxes.

Individual Income Tax Return or Form 1040-SR US. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. So if you drove 5000 miles for DoorDash your tax deduction would be 2875.

That would make my taxable income 105990 2936 - 187610 105990 So I would owe approximately 30 of 105990 which makes my tax liability 31797. No taxes are taken out of your DoorDash paycheck. Tax Return for.

110 of prior year taxes. To file taxes as a DoorDash driver aka. Collect and fill out relevant tax forms.

All you need to do is track your mileage for taxes. In 2020 the rate was 575 cents. The forms are filed with the US.

100 of prior year taxes. Basic Deductions- mileage new phone phone bill.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Delivering For Grubhub Vs Uber Eats Vs Doordash Vs Postmates Youtube Postmates Doordash Uber

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educational And Informational In 2022 Tax Guide Tax Doordash

Become A Driver Deliver With Doordash Alternative To Hourly Jobs Hourly Jobs Money Making Jobs Doordash

Doordash Tax Guide What Deductions Can Drivers Take Picnic S Blog

Products And Partnership Plans Doordash For Merchants

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance